For the past decade, two intertwined forces have quietly warped the U.S. residential real estate and home-building industries: the explosion of speculative house-flipping and the widespread use of undocumented, off-the-books labor by general contractors (GCs) and flippers. Far from being separate issues, these practices feed each other in a vicious cycle that has driven up prices, lowered construction quality, squeezed out legitimate builders, and made the dream of affordable homeownership increasingly unattainable for ordinary families.

The Flipping Boom: From Side Hustle to Industrial-Scale Speculation

House-flipping was once the domain of a few savvy locals who bought distressed properties, fixed them up, and sold them for a modest profit. After the Great Recession, private equity firms, hedge funds, iBuyers (Zillow, Opendoor, Offerpad), and crowdsourced “fix-and-flip” lenders turned it into a multi-billion-dollar asset class.

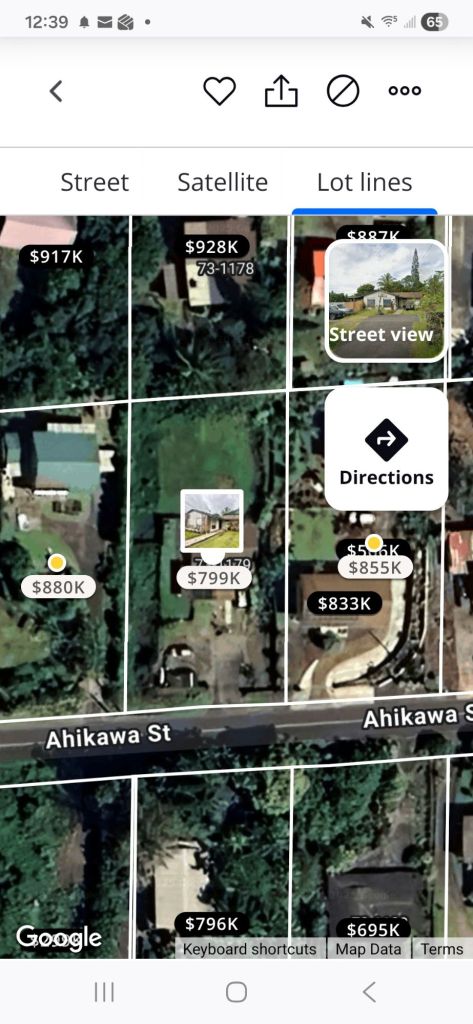

By 2022, investors purchased nearly 30% of all single-family homes sold in some Sun Belt markets (Atlanta, Phoenix, Tampa, Las Vegas). ATTOM Data Solutions reported that in Q1 2022 alone, 114,706 homes were flipped nationwide—roughly 1 in 10 transactions. Gross flipping profits hit record highs (often $70,000–$100,000 per house) because flippers weren’t competing against families; they were competing against other flippers armed with cheap debt and algorithmic bidding tools.

The result? Entry-level and move-up homes that should have gone to owner-occupants were pulled off the market, cosmetically renovated, and relisted 60–120 days later at 30–50% markups. Neighborhoods that once turned over organically became flipping factories.

The Illegal-Labor Pipeline That Makes It All Possible

Flipping at this volume and speed is only profitable if renovation costs are crushed to the bone. That’s where illegal alien laborers, non licensed contracting and other labor-law violators come in.

A typical flip budget might allocate $40,000–$60,000 for a full cosmetic gut rehab (kitchen, baths, flooring, paint). Legitimate, licensed contractors using W-2 employees, proper workers’ comp, liability insurance, and prevailing-wage or union rates simply cannot perform that work for the price flippers demand. The math doesn’t work.

So the work is subcontracted—often three or four layers deep—to Chuck in a truck handymen, or crews paid cash, no payroll taxes, no overtime, no workers’ comp, no OSHA compliance. A framer who should earn $35–$45/hour on the books gets $18–$22 cash. Drywall hangers, painters, and tile setters are routinely paid $12–$15/hour flat, no matter how many hours they work. Many of these workers are illegal aliens, or workers unhireable in normal companies, work unions and have zero recourse if injured or cheated.

This isn’t anecdotal. Federal and state labor departments have raided hundreds of construction sites in Texas, Florida, Georgia, and the Carolinas in recent years and found exactly these patterns. In 2023 alone, the U.S. Department of Labor recovered more than $1.2 billion in back wages across all industries, with construction consistently ranking in the top three for violations.

The Death Spiral for Legitimate Builders

Legitimate small and mid-sized home builders and remodeling contractors are being driven out of business because they cannot compete on price with flippers and large production builders who quietly tolerate (or actively encourage) the same off-the-books practices.

A custom or spec builder quoting a new home or major renovation to a private client has to charge 25–40% more than the flipper down the street who is using illegal labor. Clients don’t see the hidden costs—they only see the lower bid. Over time, honest contractors either close their doors, switch to cash-only themselves to survive, or get pushed into ever-smaller niches (ultra-high-end work that flippers dont have the skill and cannot produce ).

The pipeline of skilled, legal tradespeople has also collapsed. Young Americans who should be entering have been swayed by drugs, video games, state sponsored media and the liberal DOE Apperatus to look at construction as a menial, and low level. Apprenticeship programs are withering, and the median age of a skilled tradesperson is now pushing 50 in many markets. We are literally running out of people who know how to build houses the right way.

The Hidden Costs Everyone Pays

The damage doesn’t stop at exploited workers and legitimate contractors who have been shunnedby the justice system. It ripples through the entire market:

1. Artificially inflated home prices

Flippers using illegal labor can pay more for the original property because their rehab costs are 30–50% lower than legitimate players. This pushes up acquisition prices for everyone.

2. Declining construction quality

Cash crews have every incentive to cut corners—thin drywall mud, no backer board behind tile, improper flashing, unpermitted electrical and plumbing. Five to ten years later, homeowners discover $50,000–$100,000 mold and structural disasters hidden behind fresh paint and quartz countertops.

3. Higher insurance premiums and local taxes

Uninsured workers get hurt (construction is already one of the most dangerous industries). They show up at emergency rooms, and those costs are socialized through higher premiums and hospital bad debt—costs borne by every taxpayer and homeowner.

4. Erosion of the tax base

Billions in payroll taxes, income taxes, and workers’-comp premiums are evaded every year. State and local governments lose revenue exactly when they need it most to fund schools and infrastructure in fast-growing exurbs filled with flipped houses.

5. Black-market normalization

When the public sees that “everyone” in construction pays cash and cheats, the social contract breaks down. Young people entering the trades learn early that the only way to make money is to break the law.

Breaking the Cycle

None of this is inevitable, but fixing it requires political will that has been conspicuously absent:

– Strictly enforce labor laws on job sites (more inspectors, stiffer penalties, mandatory E-Verify for all contractors pulling permits).

– Close the loophole that lets general contractors claim subcontractors are “independent” when they’re functionally employees.

– Tax flipping profits at ordinary income rates (or higher) when a property is sold within 24–36 months.

– Require disclosure of investor purchases and flipping activity on MLS listings so buyers know they’re bidding against Wall Street, not a family.

– Offer meaningful tax credits and loan guarantees to legitimate builders and contractors who use fully documented, insured labor.

Until something disrupts this model, the house-flipping machine—fueled by illegal labor and cheap debt—will keep churning. Entry-level homes will remain scarce, prices will stay artificially elevated, construction quality will continue to decline, and another generation of American workers will decide the trades aren’t worth the risk.

The irony is bitter: in the rush to turn housing into just another financial asset, we have broken the very industry that creates the asset in the first place. And as long as the profits keep flowing, few of the people at the top seem to care who pays the real cost.

Discover more from South Pacific Concrete & Masonry LLC

Subscribe to get the latest posts sent to your email.